The financial future of the Walt Disney Company seems like it’s been on a roller coaster lately.

While Disney World has had its hands full battling Florida’s Governor for control over the former Reedy Creek Improvement District (RCID), Disney’s corporate level has been experiencing its own challenges with public figures calling for the immediate resignation of CEO Bob Iger. Now, we’re getting word that a major investor of The Walt Disney Company plans on pulling its multi-million dollar funding from Disney calling investing with them “risky.”

Disney may be in for another financial setback since plans have been announced for the state of South Carolina to pull its state funding out of the entertainment company’s portfolio, according to Fox Business.

Curtis Loftis, South Carolina’s State Treasurer, has decided to divest the state’s funding to Disney. His reasoning behind the decision is that he feels the company’s management has abandoned their fiduciary responsibilities.

“I think it’s clear to anybody paying attention that there’s a structural rot inside of Disney. It’s deep, it’s pervasive, and I suspect Bob Iger, since his return as the CEO, now realizes it can’t be fixed,” Loftis told Fox Business Digital, adding that operating around this business structure “does not bode well” for the future of the company. According to Fox Business Digital, the portfolio of the State Treasurer’s Office includes a whopping $105 million in Disney debt securities that Loftis intends not be renew upon maturity.

Loftis has also openly criticized Disney’s acceptance of Environmental, Social, and Governance (ESG) criteria, and argues that it deviates from the most basic foundation of investing. “People sometimes forget that ESG has nothing to do with investing,” said Loftis. “ESG is a speech and behavior code that was … created by the left and delivered to everybody else under these virtuous circumstances, or presumed circumstances.”

However, the most significant issue that concerns Loftis, however, lies more within the individuals running the company and not necessarily its adopted policies. Loftis appears to be less than enthusiastic about the recent cultural and managerial shifts within The Walt Disney Company and holds these changes responsible for the company’s recent lack of performance. “The sane, sober, talented, mature people are gone, and now you have the gender studies crowd running Disney,” he went on to explain. “That’s why their movies are flops and their market cap, I think, is about half what it used to be. It’s a tremendous loss to America, we all grew up on Disney.”

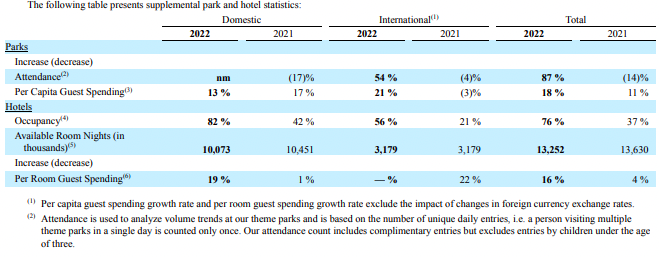

Overall Disney’s stock is still down over 50% from its all-time high of $201.91 recorded in March 2021 even at its current standing which roughly reflects a 4% rise to date this year. But the numbers aren’t all bad for The Walt Disney Company. Disney’s fiscal quarter ended September 30th and those findings reflected that the company generated $21.2 billion in revenue, marking a 5% increase year over year.

Previous to Loftis’ most recent remarks about pulling the state’s funding from Disney, he has mentioned in the past that when his state exits from Disney investments, he’s confident that minimal material impact will be felt by the company. “We’re not going to cause Disney any real harm,” he said, “I just want other people to see that you can stand up to these people and you live to invest another day. There are plenty of good investments out there that aren’t as risky as Disney.”

In Disney’s 2022 annual report, the company also remarked that it had no assurance it would make its ESG goals or that its “initiatives will achieve their intended outcomes.” Disney also expressed heightened awareness that the additional investments, new practices, and reporting processes it has recently put into motion with the company’s business model could impact its bottom line. However, the company may chalk the growing pains and losses up to being a cost of doing business, noting that ESG matters have become an increasing focus for U.S. and international regulators, investors, and stakeholders.

We’ll be keeping watch on how Disney continues to perform with the intended pull of funding from South Carolina and see if other investors follow suit. Be sure that you’re following us at AllEars for the latest in Disney news and updates.

NEW Disney World Permit Could Mean CHANGES for a Hollywood Studios Restaurant

Join the AllEars.net Newsletter to stay on top of ALL the breaking Disney News! You'll also get access to AllEars tips, reviews, trivia, and MORE! Click here to Subscribe!

Could this spark a massive exit of funding from several investors to Disney? Give us your thoughts in the comments below.

Exactly, what a joke. Disney has been one of the safest investment. Someone else will buy more now.

Never understood why Gov. Descumbag went after Disney trying to hurt the State pension fund for millions of hard working teachers, fire fighters and police. But common sense is not in his wheelhouse.

Really? You have no clue how the real world works. Too many investors are sick of the risk. This will absolutely spark something. Disney knows they screwed up. Iger is absolutely to blame.

Disney isn’t losing anything. Someone else will buy the shares

No one is going to buy the shares. If they were, then they wouldn’t be at an all time low and sitting there. Investors are looking to other less risky companies with a more steady foundation.

Disney’s stock price might be related to how much the pandemic impacted their overall revenue. Plus, this is about debt not stock so only thing you need to worry about is their overall ability to pay which is not in doubt. Loftus must have aspirations of higher office.

I believe this is about debt (bonds) not equity (stock), but your point is otherwise valid.

Loftus may be correct, but I have a hard time listening to anything said by a Republican of today and reported on Fox Business News.